For waste management companies, it’s an ideal time to be in the industrial waste market, says Effram E. Kaplan, managing director and principal at Brown Gibbons Lang & Co. (BGL), a Cleveland-based middle-market investment bank providing strategic counsel on mergers and acquisitions and capital markets.

In the next five to 10 years, Kaplan predicts, the sector can expect to see larger industrial waste businesses as well as larger waste management businesses growing from pursuing industrial waste and solid waste strategies. He says he also expects to see an evolution in the waste-to-value model as technology to process waste streams into alternative sources advances.

“When you think about sustainability, think about the regulatory environment and you think about the fragmented nature of the industry, the industrial waste market sector is ripe for capital to build more scalable businesses here and it is ripe for the strategics that have already built platforms to scale and add value to their clients,” he says.

BGL recently published a research report on the environmental services and sustainability sector, available at www.bglco.com/research/bgl_environmental_insider_may_2024.

In BGL’s report “Environmental Sector Progression & Outlook,” the company notes themes driving industry investment center on corporate sustainability initiatives, environmental awareness, consumer preferences, resource constraints and regulatory support.

These themes lead to advances in technology and waste recovery, with the result being a dynamic and growing industry and attractive investment opportunities.

Key players

The industrial waste sector alone accounts for an approximate $75 billion of total addressable market, or TAM, in the approximate $125 billion environmental services and waste management industry, Kaplan says. The industrial waste stream encompasses hazardous and nonhazardous waste streams, Kaplan explains, including liquids and solids coming primarily from the industrial complex but also from municipal and commercial complexes.

On the public front, the largest companies in the North American industrial waste sector, according to Kaplan, are Clean Harbors Environmental, GFL Environmental and Republic Services.

Clean Harbors, based in Norwell, Massachusetts, offers hazardous and nonhazardous industrial disposal services, specializing in treatment, storage, disposal and incineration.

Based in Ontario, GFL operates in the industrial waste industry as well as the traditional municipal solid waste (MSW) and construction and demolition (C&D) waste industries. Its Environmental Services division focuses on the collection, processing and disposal of specialty liquids and nonhazardous and hazardous waste streams.

Similarly, Republic Services, based in Phoenix, serves industrial as well as MSW and C&D markets and has been building its waste management portfolio through acquisitions.

Recent acquisitions in the industrial space include ACV Enviro and U.S. Ecology, which offers treatment, disposal and recycling of hazardous and radioactive waste as well as a wide range of complementary field and industrial services. ACV Enviro offers industrial services in addition to a broader range of waste services under the Republic Services umbrella.

Enviri, based in Philadelphia, is another major player in the industrial sector, Kaplan says. One of the company’s divisions is Clean Earth, which provides essential processing, treatment, disposal and recycling solutions for a wide range of complex, highly recurring waste streams such as hazardous and nonhazardous waste, contaminated soil and dredged material.

Major private companies that are large and scalable include two under the ownership of EQT Private Equity—Reworld, a Morristown, New Jersey-based company operating in the nonhazardous industrial waste business, and Indianapolis-based Heritage Environmental Services, which is primarily a hazardous waste business.

Kaplan notes that VLS Environmental Solutions, based in Houston and owned by I Squared, also is a big name in the sector. Its industrial services division tackles projects such as facility decontamination, equipment and tank cleaning, lab packs, bio and regulated medical waste, and emergency response. Its hazardous waste business was materially advanced and continues to rapidly grow via the strategic acquisition of Texas Molecular.

Based in Hoffman Estates, Illinois, Heritage-Crystal Clean, formerly public and now privately held company owned by J. F. Lehman & Co., offers a wide suite of services, including industrial management.

“There are a number of other players that are impressive, that are growing,” Kaplan says. “Triumvirate Environmental is an evolving platform with an impressive network of transfer and processing capabilities. The company is well-positioned to advance the platform via an aggressive acquisition campaign to expand geography and internalize waste streams.”

Triumvirate Environmental, based in Somerville, Massachusetts, offers a wide suite of services that encompasses industrial waste.

York1 Environmental is a Canadian business making a name in the market, while Ohio-based Valicor and North Carolina-based Shamrock Environmental are both heavy into liquids management, Kaplan says.

Another name to know is The Amlon Group. The Plano, Texas-based company offers reclamation services including material recovery and recycling. It provides solids and liquids processing for both hazardous and nonhazardous waste.

Sector consolidation

The industrial waste sector has seen consolidation over the last decade.

The driving factor behind that industry consolidation is the same as in any other industry, Kaplan explains.

“It’s to be able to protect your margin, provide better services to your customers, and that’s what’s been happening,” he says. “Municipal solid waste has been going through this for decades and there’s still a lot of opportunity.”

From a regulatory perspective, Kaplan explains, there’s more opportunity for building businesses in the traditional solid waste business than there has been historically. As the U.S. Department of Justice’s Antitrust Division gets more involved in mergers and acquisitions, he says, there’s been increasing governance on how much large public companies can consolidate and what they can consolidate.

“That’s ratcheting down the ability for the large players to pursue the large, scalable assets that they’d like to acquire now in the traditional MSW and C&D waste sectors,” Kaplan says.

“On the industrial side, [consolidation] is something that hasn’t been pursued for many years and is earlier innings than traditional MSW and C&D waste,” he adds.

It’s why Republic pursued U.S. Ecology, Kaplan explains, and why Veolia is getting more aggressive to consolidate the market.

“This is why you see businesses like GFL Environmental being able to scale and grow because most of the other players haven’t had the balance sheet flexibility to do this, and [GFL has] a visionary management team to be able to do this,” he says.

Industrial waste can be viewed as a solid waste business, only with slight differences in waste processing, disposal and customer contracting dynamics. Otherwise, the two are very similar in terms of vertical integration of the businesses from a collection, processing and disposal capability.

“It’s a massively more fragmented market, but very equal in terms of size—and growing,” Kaplan says.

In five to 10 years, look for a more consolidated industrial market, Kaplan says. He predicts the market will be more subscale but will include respectable-sized traditional waste platforms.

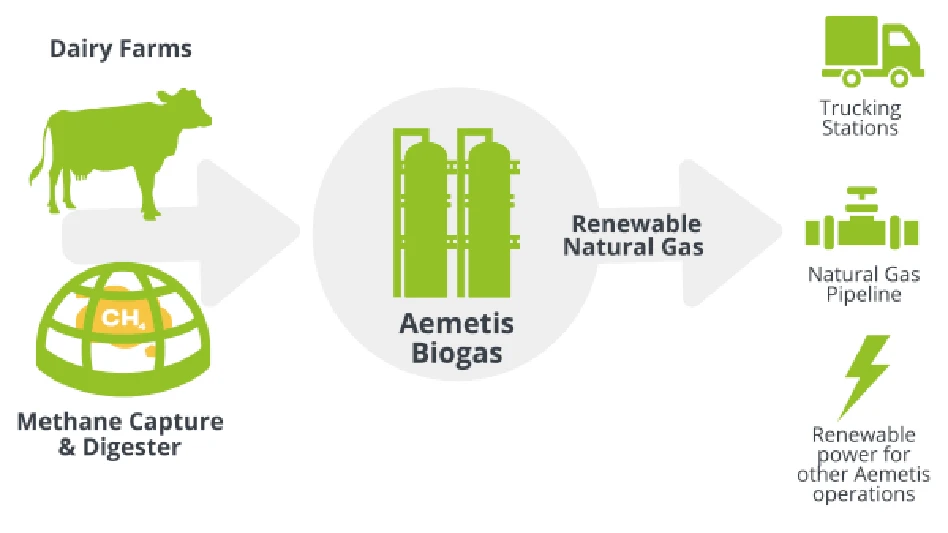

“I think you’ll see more advancements in technology to process waste streams into alternative sources compared to purely disposing,” he says. “It means the waste-to-value business model will evolve as technology gets more advanced to process those waste streams.

Capital markets

For companies in the industrial waste sector, the private capital market offers significant opportunity for potential expansion. Large pools of capital have been raised to pursue initiatives ranging from climate to resource conservation to sustainability, he says.

The capital markets see opportunity in environmental services that stretch beyond disposal, Kaplan says, whether that’s processing waste streams, collecting waste streams or sending waste streams for alternative uses.

“The disposal model will be there for a very long time, but capital is going to monetize those waste streams as a usable source into some process,” he says. “You see capital being raised in the form of climate funds, sustainability funds, waste-to-value, decarbonization and energy transition, and so things will change.”

Kaplan says he also sees opportunity to consolidate on a regional basis.

“Similar to solid waste, eventually scale will dominate because scale is critical,” he says. “Facility network and population density are important, so you can see regional players taking advantage as the market consolidates. There’s opportunity for capital to do that and for regional players to do that, but you can eventually see them being acquired by some of the larger winners.”

Explore the October 2024 Issue

Check out more from this issue and find your next story to read.

Latest from Waste Today

- Capital Waste acquires Tennessee Waste Haulers

- Van Dyk partners with Reckelberg Environmental Technologies

- CRI submits comments to CalRecycle on CRV handling payments

- Reworld acquires EnviroVac Waste Transport

- Waga Energy partners on RNG project at France landfill

- Hawaiian county selects landfill site

- CAA submits final draft program plan in Oregon

- Washington city adds organics collection to waste service