Pawinee | stock.adobe.com

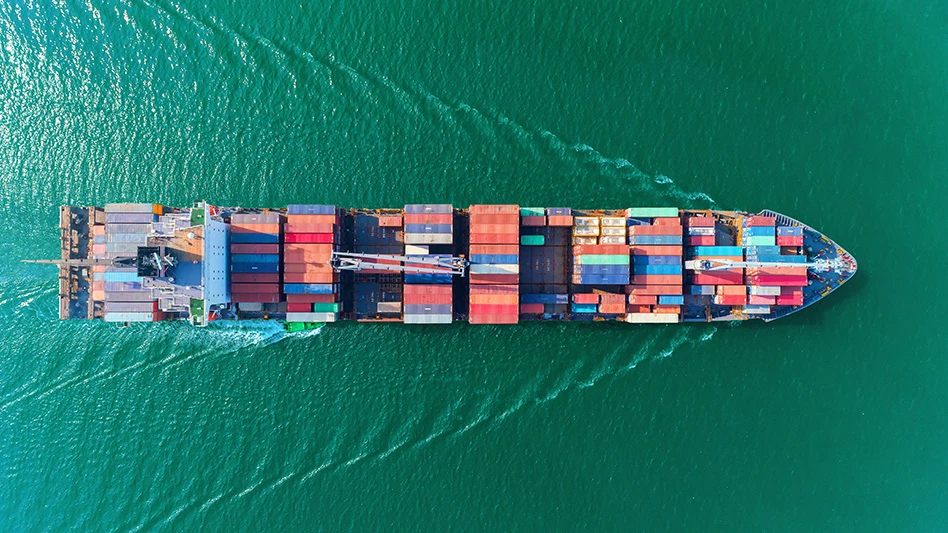

Weston, Massachusetts-based Vanguard Renewables has announced a commercial partnership with the CMA CGM Group, a France-based logistics solutions company, designed to support the decarbonization of its shipping activities.

Under the terms of the agreement, CMA CGM will make a minority investment in Vanguard Renewables through its energy fund, Pulse, ensuring access to RNG to be delivered on a long-term basis.

Vanguard Renewables offers a network of solutions to divert organic waste from landfills and collaborates with food and beverage manufacturers and retailers seeking organic waste disposal options. The company produces RNG through anerobic digesters that are powered by farm and organic waste. Vanguard Renewable says it will dedicate up to four projects to CMA CGM production.

RELATED: Vanguard AD installation goes online in Wisconsin

“We are thrilled to partner with CMA CGM, the third largest container shipping company in the world, in support of their decarbonization objectives,” Vanguard Renewables CEO Michael O’Laughlin says. “We see this pioneering collaboration as a key step in supporting the maritime sector as the global industry takes a bold step toward improving emissions. Vanguard Renewables’ unique business model provides a blueprint for a truly circular solution that offers significant benefits for GHG emission reduction and diverting organic waste from landfills.

"With a national footprint, backing by BlackRock and a proven ability to scale to meet the increasing demand of RNG globally, Vanguard Renewables is committed to providing a reliable clean fuel source for years to come.”

CMA CGM Group’s investment in Vanguard Renewables comes as the International Maritime Organization (IMO) recently announced its Net-zero Framework. Under the draft regulations, shipowners must reduce greenhouse gas (GHG) emissions or face financial penalties if they exceed a GHG fuel intensity threshold. Vanguard Renewables says this partnership highlights the potential of liquefied natural gas (LNG) vessels as a transitional solution toward bioLNG playing an active role in advancing the decarbonization of the shipping industry.

Guggenheim Securities LLC served as financial advisor to Vanguard Renewables in connection with this transaction.

Latest from Waste Today

- Vermeer announces plan to build new facility in Des Moines metro area

- Buffalo Biodiesel shares updates on Part 360 application to DEC, Tonawanda facility progress

- Capstar Disposal expands roll off dumpster rental services

- Supreme Court strikes down IEEPA tariffs

- Casella details facility closures, expansion efforts

- Zero harm: Building a SIF prevention program for waste and recycling operations

- Casella posts a loss in Q4 2025

- McNeilus names Haaker Equipment first Dealer Partner of the Year